Women’s Guide to Financial Independence: Steps to Take Control of Your Finances and Secure Your Future

This post may contain affiliate links, if you buy a suggested product I will earn a small commission. We are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.” Read the full disclosure policy here.

Achieving financial independence is one of the most empowering steps you can take as a woman. It’s about taking control of your financial future, gaining confidence in your decisions, and ensuring security no matter what life brings. Whether you're just beginning your financial journey or looking to enhance your financial knowledge, this guide offers actionable steps to help you achieve true financial independence.

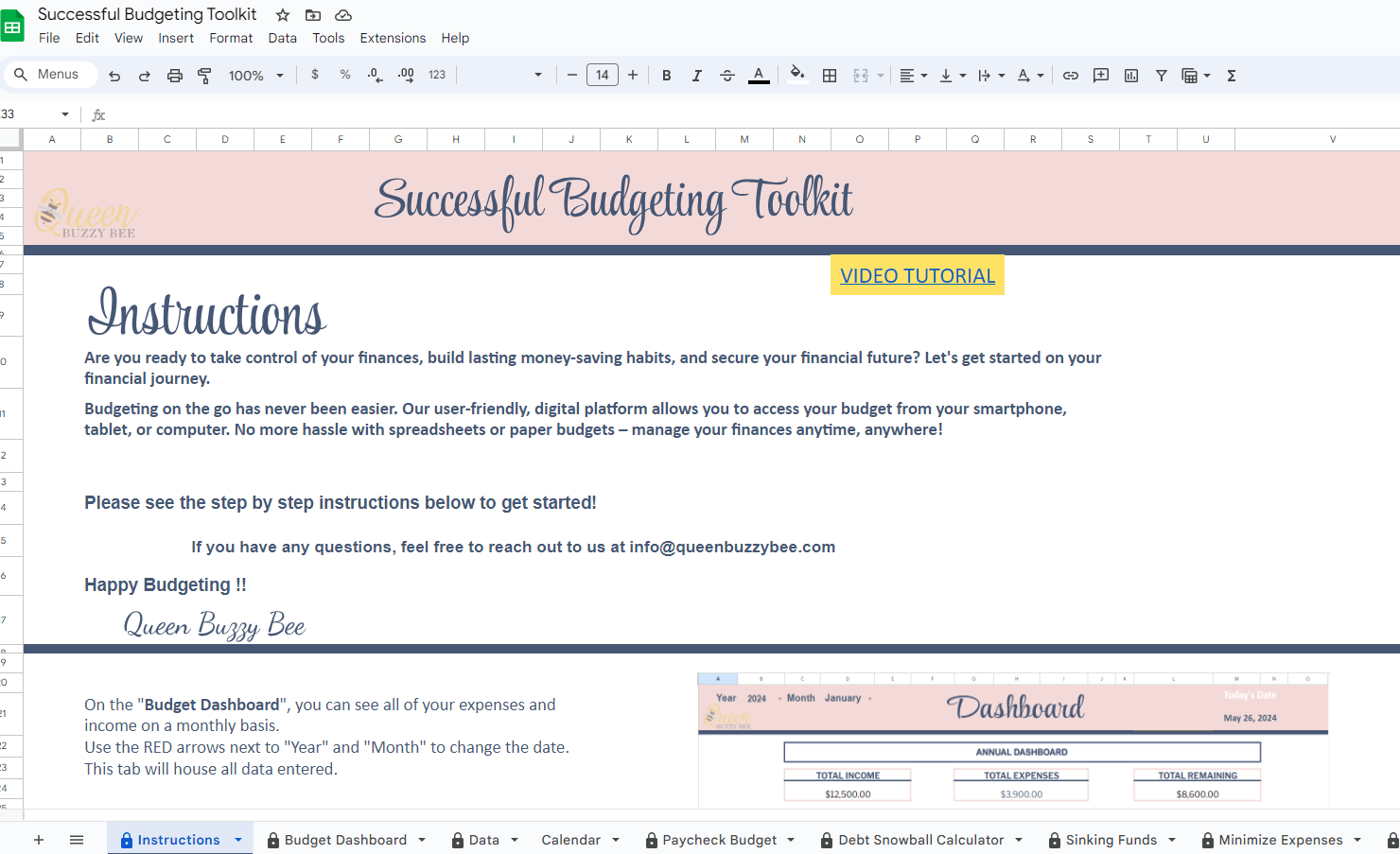

You can complete all of the steps below using the

Define Your Financial Goals

Financial independence starts with clarity. Knowing what you want to achieve financially will keep you motivated and focused.

Action Steps:

Identify your short-term and long-term financial goals, like saving for an emergency fund, buying a home, or investing for retirement.

Write down your goals and review them regularly to stay on track.

Establish a Budget You Can Stick To

A budget is essential for tracking income, expenses, and savings. It’s the foundation of financial independence.

Action Steps:

Choose a budgeting method that works for you, such as the 50/30/20 rule (50% for needs, 30% for wants, 20% for savings).

Use a budgeting app to automate tracking, like Mint or YNAB.

Resource:Successful Bidgeting Toolkit – A budgeting sheet to help you categorize spending and set financial goals.

Build an Emergency Fund

An emergency fund acts as a safety net for unexpected expenses. It protects you from debt and financial stress.

Action Steps:

Start small, aiming to save $1,000, then build up to 3-6 months’ worth of living expenses.

Set up an automatic monthly transfer to a high-yield savings account.

Resource:Ally Bank – Known for high-yield savings accounts with no minimums or fees.

Invest in Your Future

Investing is key to growing wealth over time. It can help you build a secure financial future and achieve independence.

Action Steps:

Contribute to retirement accounts, like a 401(k) or IRA, especially if your employer offers matching contributions.

Start small with low-cost index funds or ETFs, which are great for beginners.

Resource:Vanguard – Known for low-cost index funds and ETFs ideal for long-term growth.

Prioritize Debt Repayment

Debt can be a major barrier to financial independence. Paying it off will free up income for saving and investing.

Action Steps:

List your debts and choose a repayment strategy (debt snowball or avalanche method).

Consider refinancing or consolidating if you have high-interest debt to lower your interest rates.

Resource:Undebt.it – A free tool that helps you create a customized debt payoff plan.

Develop Multiple Income Streams

Diversifying your income can provide stability and additional funds for savings or investments.

Action Steps:

Explore side hustles or freelance opportunities that fit your schedule and interests.

Consider passive income sources like dividend stocks or digital products.

Resource:Upwork – A platform to find freelance jobs in various fields, allowing you to earn extra income.

Focus on Financial Education

Understanding finances empowers you to make informed decisions, avoid scams, and grow your wealth.

Action Steps:

Dedicate time to learning about personal finance, budgeting, investing, and tax planning.

Read finance books, listen to podcasts, and attend workshops.

Resources:

Books: Smart Women Finish Rich by David Bach and You Are a Badass at Making Money by Jen Sincero.

Podcasts: HerMoney with Jean Chatzky and The Financial Feminist with Tori Dunlap.

Protect Your Wealth

Protecting your assets through insurance and estate planning is crucial for long-term financial security.

Action Steps:

Review your insurance coverage for health, life, and disability.

Create an estate plan and designate beneficiaries to protect your wealth and assets.

Resource:Policygenius – An online tool that helps you compare insurance policies and find the best options.

Financial independence is a journey, and every step you take brings you closer to the life you want. By setting clear goals, managing your budget, paying off debt, and investing wisely, you can achieve lasting financial security. Remember, this journey is about progress, not perfection. Start where you are, use the resources available, and celebrate every milestone along the way.

Ready to Gain New Budgeting Skills?

Get Your Financial Tips

The insights you need to make smarter financial decisions.

Newsletter